- Highest & Best

- Posts

- 💰 A Loan at the Top

💰 A Loan at the Top

Airbnb condo site faces foreclosure; a mellowed housing market

Happy Sunday Highest & Best! Here’s a rundown of news from the South Florida real estate week that was:

⚖️ Airbnb-style condo tower faces foreclosure

🌤️ South Florida housing market: mellowed, but not melted

🛍️ Zara billionaire adds Miami office to his cart

🏌️♂️ Homebuilders ❤ Boca golf courses

Let’s get to it!

Airbnb-Style Condo Site Faces Foreclosure in Fort Lauderdale

The site of Natiivo Fort Lauderdale is facing foreclosure (Photo: Newgard Development)

A downtown Fort Lauderdale development site, touted as the future home of the city’s first “Airbnb-style” condo tower, is facing a foreclosure sale.

The 1-acre parcel at 200 West Broward Blvd. — where Newgard Development Group is planning the 40-story, 384-unit Natiivo Fort Lauderdale — is the subject of a lawsuit filed by lender Kushner Companies, which is seeking to recover a $22.9 million mortgage debt.

Developer Newgard borrowed $21.24 million in December 2023 on an 18-month loan, pledging 100% of its equity in the property as collateral, according to court filings flagged by Vizzda. The loan matured last month and has not yet been repaid. So the lender is seeking a court-ordered sale of the high-profile site to satisfy the balance, plus interest and fees.

Newgard, for its part, says a sale won’t be necessary. In a statement Friday, the developer said it’s “actively in the process of refinancing the project,” pointing to “unique challenges and delays” in today’s lending environment. The original lender was unwilling to extend the loan, but Newgard says fresh financing may soon take its place.

“We remain confident that the matter will be resolved shortly and that we will move forward as planned,” the company said.

Unveiled in early 2024, Natiivo Fort Lauderdale was pitched as a condo tower for investors — a place where owners could rent out their fully-furnished units on Airbnb nightly, no restrictions attached.

Construction hasn’t begun yet. The planned tower would feature units ranging from 500 to 1,200 square feet, with prices from the $500,000s to $1.5 million.

It’s part of Newgard’s broader Natiivo brand, which has launched similar projects in Miami and Austin — both of which sold out before construction was complete.

“The Splash” pool area in the planned Natiivo Fort Lauderdale (Newgard Development)

⏪ Catch up on recent Highest & Best issues:

Another One Buys the Dust, July 6, 2025

Put it in Reverse, June 1, 2025

Get the Parting Started, May 24, 2025

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

South Florida Home Market Mellows, Not Melts

Florida housing inventory reached records this year. Is that good?

If you’ve been waiting for South Florida’s housing market to buckle under the weight of record inventory — keep waiting.

In Q1 2025, several Florida markets hit all-time highs for home listings: Delray Beach, Fort Lauderdale, West Palm Beach — and even St. Petersburg (yes, I see you Gulf Coast), according to Miller Samuel and Douglas Elliman.

So what happened next?

The Q2 numbers just dropped, and rather than a housing apocalypse, we got something less dramatic: moderation.

Prices in some places ticked up, others ticked down. Turns out, matching demand with long-awaited supply cooled the market to a more livable temperature, says Jonathan Miller, president of appraiser Miller Samuel.

“Prices aren’t running away from consumers like they were because supply is coming into the market again,” Miller said in an interview. Bidding wars are not as common, meaning far fewer buyers are paying above a home’s asking price, he said.

“What we’re seeing is a stabilization of the market as opposed to a massive oversupply,” he said.

Here’s how it played out by city in the second quarter, according to reports released this week by Miller Samuel and Douglas Elliman Real Estate:

Delray Beach: After hitting its highest inventory on record in Q1, single-family home prices slipped 2.7% to a median of $815K, and condo prices fell 3.8% to $250K.

Fort Lauderdale: Single-family home prices rose 3.3% to $620K. Condo prices dipped just 0.6% to $432,500.

West Palm Beach: This one zigged and zagged—median single-family home prices jumped 4.1% to $582,500, while condo prices fell 12.7% to $240K.

St. Petersburg: Median price of single family homes slipped 5% to $444,900.

Zara’s Billionaire Founder Eyes Miami Office for His Cart

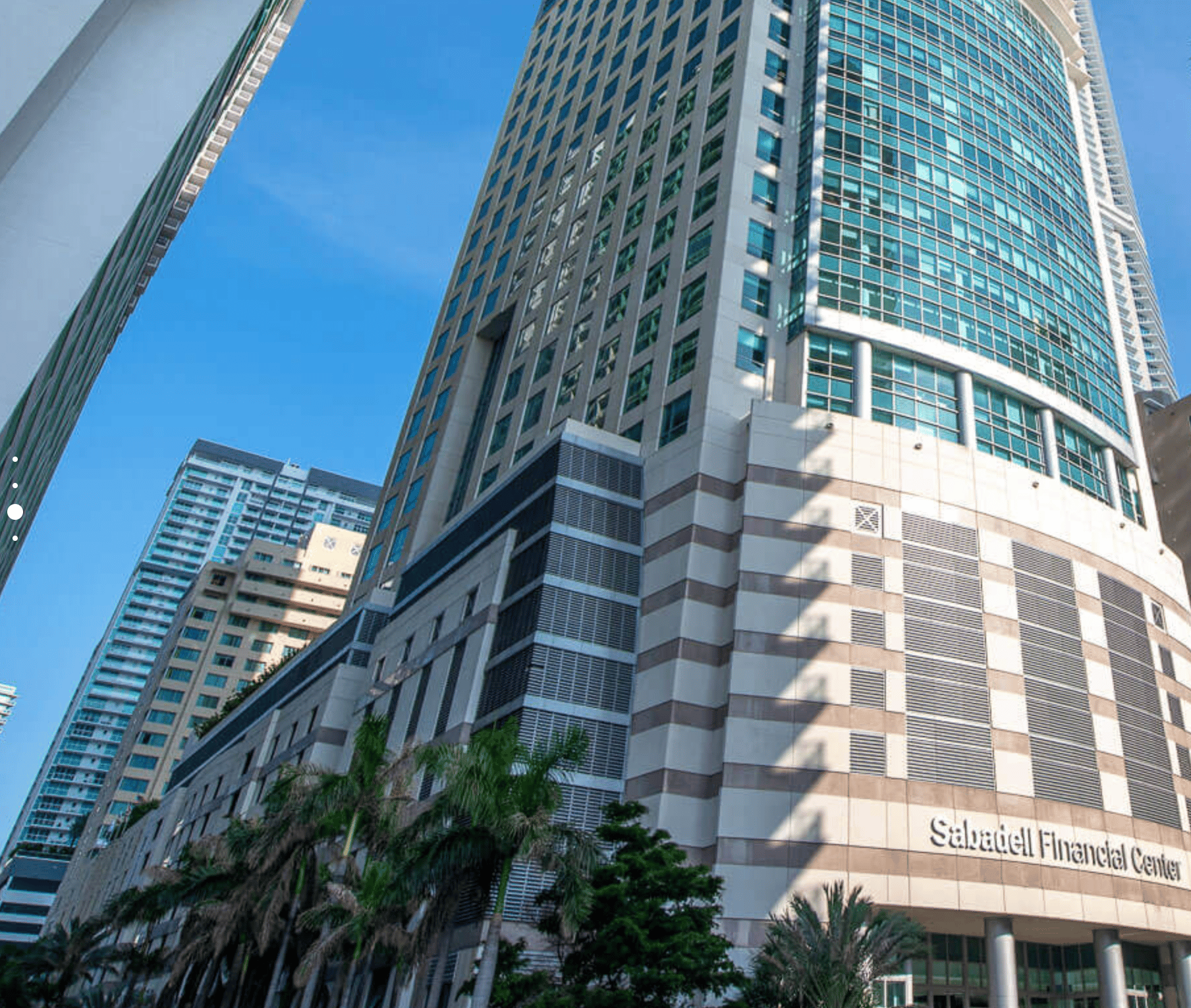

Zara founder Amancio Ortega may buy this Miami office tower

Why stop at one record-setter?

Last month, billionaire Amancio Ortega (the founder of fast-fashion chain Zara) — dropped $165 million on a brand-new apartment tower in downtown Fort Lauderdale. The price for Veneto Las Olas, worked out to $637,000 per unit, among the highest prices paid for a rental complex in South Florida this year.

Now he’s going for office.

Ortega’s investment firm, Pontegadea, is in talks to buy the Sabadell Financial Center in Miami’s Brickell neighborhood for around $275 million, according to published reports. The deal, if it closes, it would mark the largest office sale in Florida so far this year.

And it would be a decent sign that Brickell office buildings remain attractive to investors, even as Miami’s office leasing activity has cooled from its 2021 highs.

Brickell, Miami’s go-to address for financial and legal firms, still commands premium office rents — and those rents are still rising. Average asking rents for Class A office space in Brickell climbed 5.1% in the second quarter from a year earlier to $104.65 per square foot, per brokerage CBRE.

Ortega, the Spanish billionaire, has been steadily adding a bit of everything to his Florida portfolio, which includes retail buildngs, a hotel and another office complex in Coral Gables. In 2023, he paid $113 million for a cold storage warehouse in Hialeah — which turned out to be he second-largest industrial deal in the state that year.

Homebuilders Are Zeroing in on Boca’s Golf Land

Boca Raton golf courses are becoming the darlings of national homebuilders.

Toll Brothers is the latest to set its sights on Boca’s fairways — not for a round of golf, but for a brand-new neighborhood of suburban homes. The luxury builder, ranked among the largest in the U.S., wants to transform the long-defunct Hidden Valley golf course into a 74-home community, complete with lakes, a pool, pickleball courts (of course), and a new clubhouse, the South Florida Business Journal reported.

The 55-acre site at 7601 East Country Club Blvd. hasn’t hosted a tee time since 2006, and its clubhouse was destroyed by fire in 2010. Toll is seeking city approval to rezone the land from “private recreation” to “residential low,” with plans for homes on 8,250-square-foot lots.

Meanwhile, over at Boca Lago Golf & Country Club, Lennar (the nation’s second-largest homebuilder) is working on an even bigger play. The company is under contract to buy nine of the club’s 27 holes and has plans for nearly 800 condos and townhomes.

Lennar is pitching its proposal as a win-win: a path to financial sustainability for the aging club and a much-needed infusion of housing in supply-constrained Boca.

Both builders still need local approvals for their greens-to-gables plans.

That’s it for today!

Reply